TIPCO is now Nomentia

Nomentia acquired TIPCO Treasury & Technology GmbH to become a market leader in treasury management solutions.

The combined TIPCO & Nomentia offering: a complete treasury management system

Centralized liquidity management

Nomentia Liquidity

- A single source of truth to analyze cash positions throughout the entire organization.

- Monitor global cash positions across multiple banks, systems, and business units

- Dynamic data views using a variety of functionalities such as aggregation, grouping, filtering, multiple time periods, and grid or graph views.

- Historic and current liquidity positions

- Short & long-term liquidity forecasts

- Used by SMBs and Enterprises

.png?width=650&height=542&name=Liquidity%20Analyses%20%26%20Reporting%20(1).png)

Automated forecasting

Nomentia Cash Flow Forecasting

- Automatically develop cash flow forecasts based on consolidated global cash flow data from all your systems including ERP systems, banks, treasury management systems, balance sheets, and P&Ls.

- Run scenario analyses.

- Run variance analyses.

- Forecast at any level, time, horizon, or interval.

- Develop cash flow forecasts based on historical data trends or include seasonality trends and external factors like industry-specific indicators.

- The preferred solution for cash flow forecasting by multinational enterprises.

.png?width=650&height=542&name=Predictive%20analytics%20(3).png)

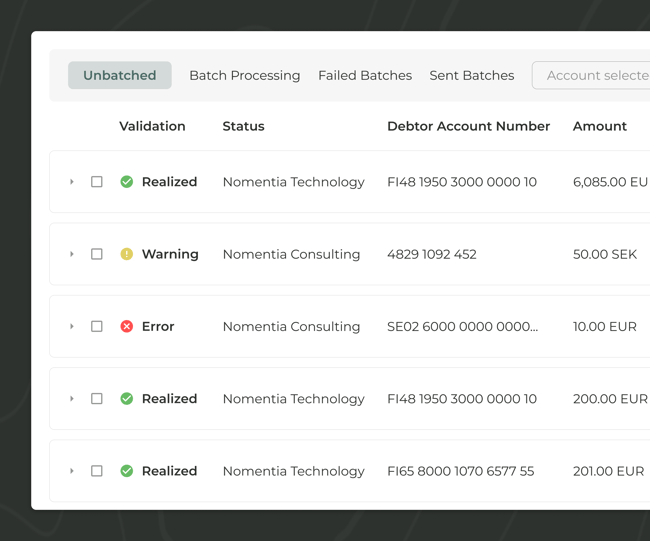

Global payment hub

Nomentia Payments

-

A global payment hub to centralize, control, and manage your end-to-end payments cycles to optimize cash and working capital while minimizing the risk of financial fraud.

- A complete payment hub for automating, managing, and centralizing local, cross-border, and global payments.

- Connect ERPs, financial systems, and banks to process outgoing payments for accounts payable, treasury, payroll, and manual payments.

- Payment fraud and anomaly detection through rule-based controls, sanctions screening, and six-eye principles.

- Execute batch or manual payments.

- A solution for companies of any size: SMBs are using Nomentia Payments as well as enterprises utilize it for setting up a payment factory.

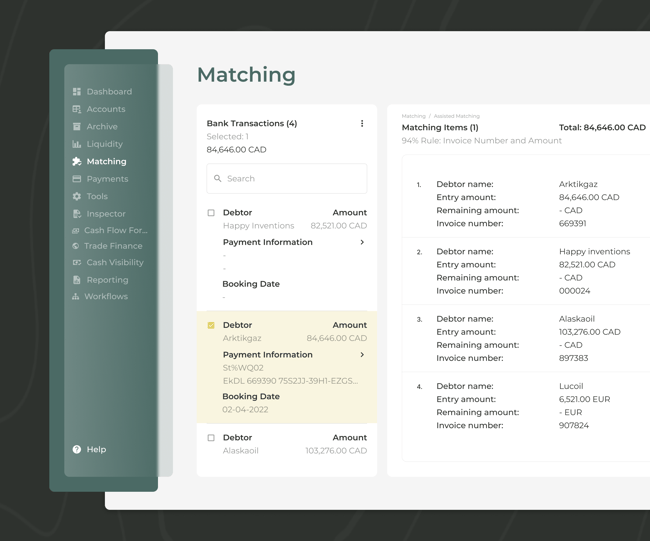

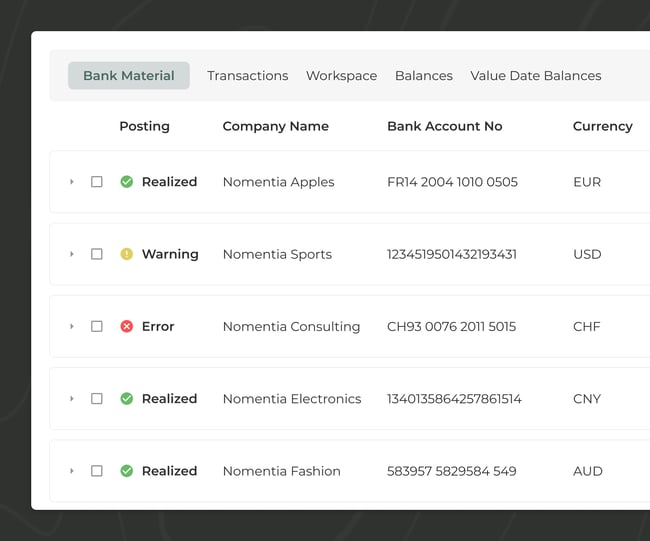

Automated matching

Nomentia Reconciliation

-

Automatically match bank statements with transaction data or post transactions to the general ledger.

- Define & implement multiple rule-based matching processes, such as balance matching, AR & AP matching, lockbox matching, e-commerce matching, and more.

- Connect with your banks or ERP to fetch all your bank materials, such as bank statements, with detailed information on transactions.

- Automatically identify and categorize bank transactions using a rule-based framework.

- Automatically enrich data from various sources to increase the percentage of automatically matched invoices.

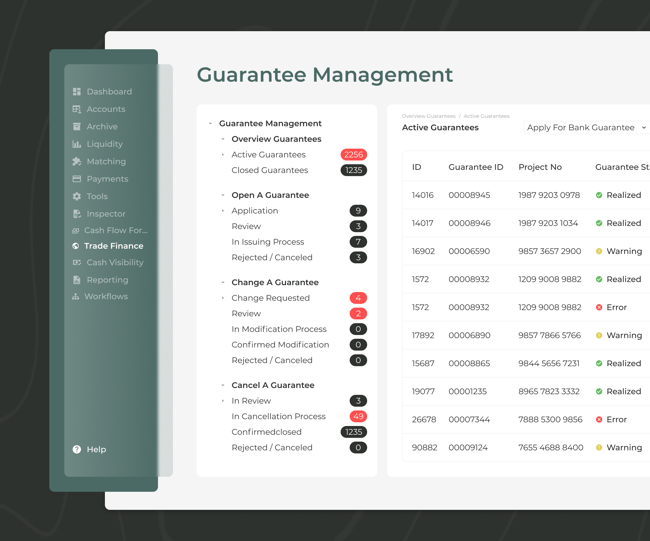

Automated & Centralized Trade Finance

Nomentia Trade Finance

-

Gain instant visibility into group-wide guarantees and guarantee status.

- Manage all internal and external guarantees and end-to-end guarantee processes in one place.

- Review all data and follow up by allocating credit facility, requesting more information, approving or rejecting applications.

-

Filter your worldwide portfolio of guarantees based on criteria like guarantee type, purpose, beneficiary, due date, guarantor, counterparty, or currency.

- Replace bank-specific request forms with a standardized request form.

- Sign request forms to banks digitally with DocuSign, Adobe Sign, or other signatory integrations, and send them to banks directly from the platform.

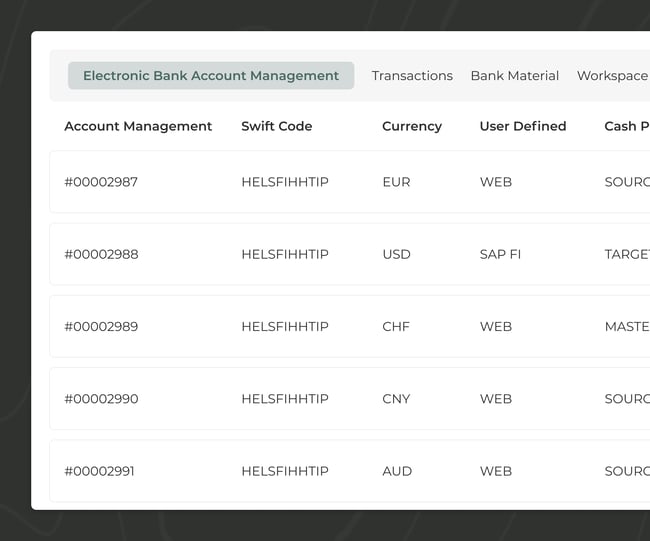

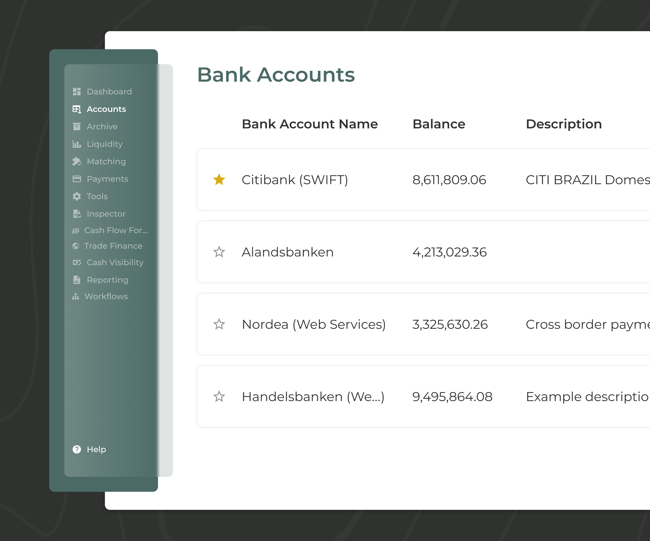

Centralized multi-bank solution

Nomentia Bank Account Management

- Retrieve, view, analyze and monitor cash flows, account statements, and payments centrally by connecting all global bank accounts.

- Automate processes such as data transfers, interfaces, and postings to minimize manual work and errors.

- User-friendly reporting, filtering, and visualization of all account data.

- Retrieve all account transactions and FX rates through one interface.

- View opening and closing balances, net flows, limits, and available funds at any desired time.

- Manage all eBAM-qualified accounts from a single platform.

Improved control & centralization

Nomentia In-house Bank

-

Improve the group’s cash and treasury management processes by centralizing payment processes, liquidity and risk management, and taking control over intercompany financing.

- Centralize outgoing and incoming payments.

- POBO & COBO.

- Receive and send payments from the group treasury’s account to the subsidiary’s internal accounts

- Cover short-term financing needs internally

- Automatically net and invoice internal debts with clearing

- Debt relationships between internal accounts are netted to gain control over intercompany settlements

Fully managed connectivity

Nomentia Bank Connectivity as a Service

-

Connect to over 10 000 banks globally. Fully managed connections and file format conversions between your banks, ERP, and financial systems.

- Connect with banks across the globe through host-to-host connections, local connections (EBICS), or SWIFT Alliance Lite2 for Business

- Setup & maintenance of integrations between the banks and your systems whenever necessary.

- Connect with any ERP system, for example, SAP, Oracle, Microsoft, Sage, NetSuite, and more, via API or SFTP.

- The solution is monitored and maintained by Nomentia.

Instant transparency

Nomentia Cash Visibility

-

Monitor a complete and up-to-date cash position in Nomentia’s centralized cash visibility solution. Automatically retrieve data from all internal and external systems.

- View all financial status positions on a group-wide level or drill down to entity levels.

- Monitor bank accounts, petty cash, bank fees, deposits, loans, intercompany loans, financing transactions, investments, intercompany clearing accounts, credit lines, securities, and cash inventories in one place.

- Analyze financial data at any level, from subsidiaries to bank groups or currencies. Drill data down to the smallest level such as transaction levels.

- Dashboards with global insights.

- Clear management reports with the most important information.

.png?width=650&height=542&name=Cash%20visibility%20(1).png)

Group-wide reporting

Nomentia Reporting

-

Treasury reporting based on group-wide data from any system or bank.

-

Centrally build reports and analyze treasury data with automatic data consolidation.

-

Benefit from customized treasury reports for optimal analysis in Excel, Power BI or any other BI tool.

-

Interactive dashboards and detailed analysis options.

-

Self-service customizable reports and dashboards or tailor-made with expert help.

-

Connect to any banks, TMS, ERP systems, and trading platform.

-

Directly access master data, structures, and instruments from all source systems through Excel pivot objects.

-

Use Power BI to analyze data and prepare reports.

end-to-end automation

Nomentia Workflows

- Automate and centralize end-to-end treasury processes with workflows.

- Centralize end-to-end processes for guarantees, intercompany loans, master data, derivatives, bank fees, and bank accounts.

-

Monitor all ongoing processes and remain up to date about global statuses.

-

Easily identify uncompleted and pending tasks.

-

Ensure that the right people are part of the treasury processes at the right point in time

-

Consolidate data and communication flows between local departments, shared service centers, and corporate treasury as well as ERP systems, TMS, and trading systems.

- Automated task allocation according to specific set process rules

.png?width=650&height=542&name=Workflows%20(3).png)

Manage financial risk

Nomentia Risk Management

- End-to-end exposure analysis, hedging, risk management & reporting.

-

Integrations to retrieve all essential FX data.

- Integrate market data sources or allow the solution to calculate volatilities & correlations.

- Leverage system-generated hedge proposals to reduce your exposure.

- Scenario analysis by simulating hedges and their effect on exposure and risk.

- Use the variance/covariance approach or Monte Carlo simulations.

- Use CfaR or VaR calculations to define risk exposure.

- Simulate hedging costs (“cost of carry”) for any selected level of risk reduction.

- Identify cost-optimal hedges for any desired level of risk.

.png?width=650&height=542&name=Risk%20by%20Type%20(1).png)

Decades of combined expertise

Corporate customers

projects completed last year

value of payments processed last year

employees in the Nordics, Benelux, DACH, Poland, and United Kingdom

Bank connections via host-to-host, SWIFT or local connections

TIPCO's former CEO on the acquisition

“Customers remain our priority and processes such as support or project implementation must not suffer. Our customers should continue to enjoy the quality they are used to.”

Over 1400 companies trust us – from small businesses to the world’s largest enterprises

What do our customers say?

”We were in need of a global tool that could be used in all of our locations for all of our payments. The goal was to create a harmonized way of working. One of the main drivers was security: we wanted to improve the safety of our cash outflows and simplify user rights management.”

"Once our IT understood that Nomentia can do magic by connecting to our ERP system, retrieve a file from the bank and send it to our ERP in the right format, it was easy to get their buy-in."

"Despite a heterogeneous system landscape, Nomentia providers us with an effective tool for ensuring transparency and for flexibly analyzing all of our treasury data."

"As an information logistics tool, it has been a central element of our IT treasury landscape for more than 10 years. The simplicity, flexibility, and speed of the system, combined with the industry expertise of Nomentia and its openness with regard to customer-driven developments, were the keys to our requirements being optimally implemented."

"We now have a considerably stronger negotiating position vis-a-vis banks, which have noticed that we are carefully checking statements. Besides this, we now also have an overview of products and prices. Last but not least, we have been receiving major reimbursements as a result of the checks."

"The positive outcome is that the Group Treasury and the subsidiaries may use the system on a daily basis or whenever they need information on their liquidity forecasts."

“We save valuable time every month due to the simple data management and the automated issuing of invoices.”

"This project in cooperation with Nomentia and Deutsche Bank has successfully digitalized an important area of bank account management. We are also convinced that far more is possible. We aim to keep focussing on this and invite all others working in treasury to do as we have done. This is the only way that completely digitalized bank account management can become reality."

"Nomentia is a very smart system, not a standard tool, very easy to modify to reflect our corporate structures, extremely flexible, and additional modules (FX, commodities, EMIR) can be added at any time – the Swiss Army Officers’ Knife for treasurers."

"Payments were previously taken care of locally and with various systems, so it was obviously very difficult to keep track of everything. Now we have a system that functions smoothly: all payments go through the same process, which is the same in each country."

"We use the system and the data imported from upstream systems on a daily basis to monitor the utilization of our credit lines, manage our guarantees, and analyze the allocation of business to our banking partners."

Would you like to know more about our solution offering?

Get in touch by leaving your contact details.

We’d love to meet you!

Hyper modular

Nomentia has a hyper modular approach. Take only the solutions that you need and integrate them into your existing technology stack.

Connect with your banks easily

We help you to connect with over 10 000 banks globally through host-to-host, SWIFT, and local connections.